- #REVIEW OF YOU NEED A BUDGET HOW TO#

- #REVIEW OF YOU NEED A BUDGET SOFTWARE#

- #REVIEW OF YOU NEED A BUDGET SERIES#

Learning how to budget is a lifelong journey and YNAB helps you tackle it effectively, regardless of age or current economic standing. Training Modulesīeyond the software, YNAB also offers training modules for you to browse. This makes budgeting easier and more enjoyable, which is something most people usually struggle with.

#REVIEW OF YOU NEED A BUDGET SERIES#

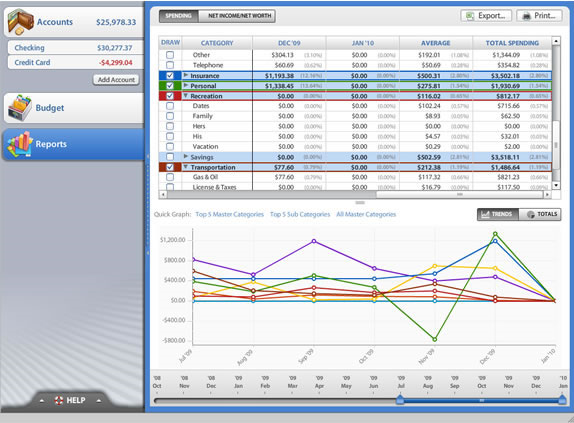

YNAB offers a detailed snapshot of all your finances with a series of charts and graphs. This feature encourages you to keep your money in checking accounts for longer periods of time and actively tracks the number of days it remains untouched.

#REVIEW OF YOU NEED A BUDGET SOFTWARE#

The software achieves this with a few interesting methods, such as the Age of Money. The fact that their import flow is a pain in the ass, led me to switch back to spreadsheets. My main gripe was the lack of multi currency support. In the end it wasnt making my life easier. YNAB’s main goal is to help you reach your own financial goals. Review of YNAB (You Need a Budget) I paid the annual subscription, read the book, watched the videos and tried to make it work. Aside from tools to help you understand your finances, you will also benefit from features that can hone your skills for financial management, such as goal tracking, budget charts, and more. As a result, it is easy to pinpoint your finances and build on it. Intuitive PlatformĮverything in this budgeting software is laid out in a clear and easy-to-navigate interface. YNAB employs an effective 4 rule budgeting approach with an elegant interface to create one of the most helpful budgeting applications out there.The main benefits of You Need A Budget are its intuitive platform, goal-setting facilities, reporting system, and training modules. Some users report that this problem worsens over time as your accounts grow although the developers are working hard to solve it. The main drawback of YNAB is that it doesn't integrate with online banking and the Adobe AIR interface, while looking great, can sometimes be slow and unresponsive.

You can also carry-over overspending (or underspending of course) from month to month. NerdWallet's mission is to provide consumers and small businesses with the tools, information, and insight they need to make financial decisions. YNAB allows you to spread spending across different categories so if you need more money for essentials one month rather than entertainment you can do so and it will even things out for you. Each section gives you advise and tips on how to organize your accounts effectively. YNAB uses what it calls the 4 rules of cash flow - Stop Living Paycheck to Paycheck, Give Every Dollar A Job, Save For A Rainy Day and Roll With The Punches. However, You Need A Budget is named as such because its all about budgeting - something it does very well indeed and if you're having financial problems, you're advised to listen to what it says. I felt compelled to manage my money in the framework they built rather than using the methods and tools I wished to apply to my own budget. You can of course, just ignore all this and open an account. Reasons for Switching to You Need A Budget: Mints free service was add supported, and they would not allow the flexibility in monthly and bi-monthly payment cycles that I needed. When you enter the main screen, YNAB acts as a kind of financial adviser, suggesting ways in which you should be managing your money. When opened for the first time, YNAB asks if you'd like to associate your downloaded bank statements with it or allow another application - such as Moneydance - to take care of that.

0 kommentar(er)

0 kommentar(er)